关于国强

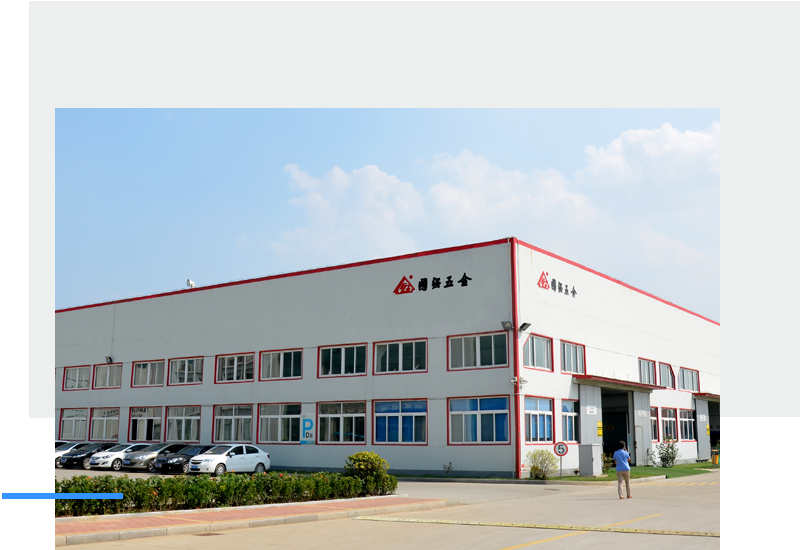

亚萨合莱国强(山东)五金科技有限公司(以下简称“公司”)是由山东国强五金科技有限公司于2015年6月底由更名而来,是在瑞典上市的亚萨合莱集团公司的全资子公司,是国内专业生产建筑门窗五金的行业龙头企业,年产各类门窗五金1800万套(件),产品涵盖门窗五金、防火门五金、商用地产五金、幕墙五金及高档胶条几大系列。

-

乐鱼官网下载-乐鱼官网入口

员工数量

-

营收增加

-

年销售额

-

并购公司

经典案例 classic case

联系乐鱼官网下载

联系乐鱼官网下载  联系乐鱼官网下载

联系乐鱼官网下载 全国免费服务热线

全国免费服务热线 社区:

社区: